AI and Automation in Accounting: Why You Still Need Accounting Course

Description

AI and Automation in Accounting: Why You Still Need an Accounting Course in 2025

The Impact of AI and Automation

AI and automation are rapidly transforming the accounting landscape in 2025. Routine tasks like data entry, invoice processing, and reconciliations are increasingly handled by intelligent software and robotic process automation. This shift allows accountants to focus on higher-value work such as financial analysis, strategic planning, and advisory roles. However, the rise of technology does not eliminate the need for skilled accounting professionals—it changes the skill set required.

Why an Accounting Course Remains Essential

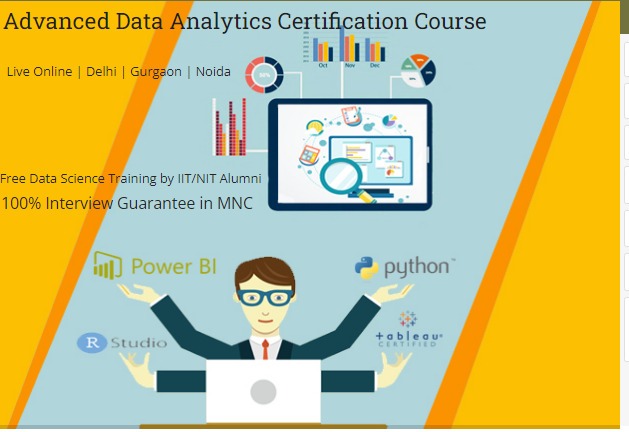

Despite automation, employers in 2025 seek accountants who combine technical knowledge with proficiency in the latest digital tools. Courses now emphasize:

-

Mastery of AI-powered accounting platforms

-

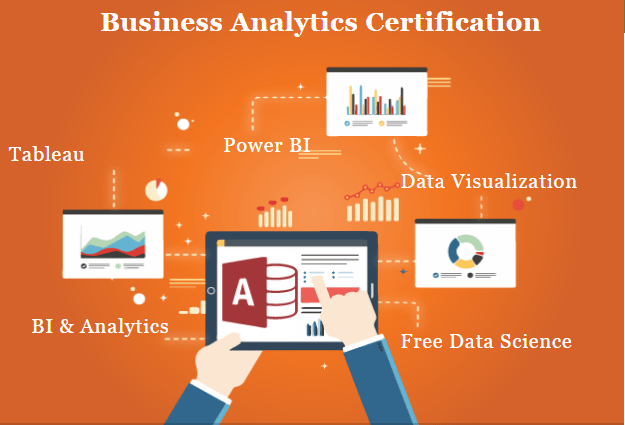

Data analytics for actionable business insights

-

Understanding of regulatory changes, such as updated GST and ITR rules

-

Strategic thinking and ethical decision-making

Continuous learning and certification are crucial to remain relevant and competitive in the evolving job market.

100% Job-Oriented Accounting Course in Delhi (110017)

Course Highlights and Certifications

SLA Consultants India offers a comprehensive, job-oriented Accounting Course in Delhi’s 110017 area, designed to meet the demands of the 2025 job market. The program features:

-

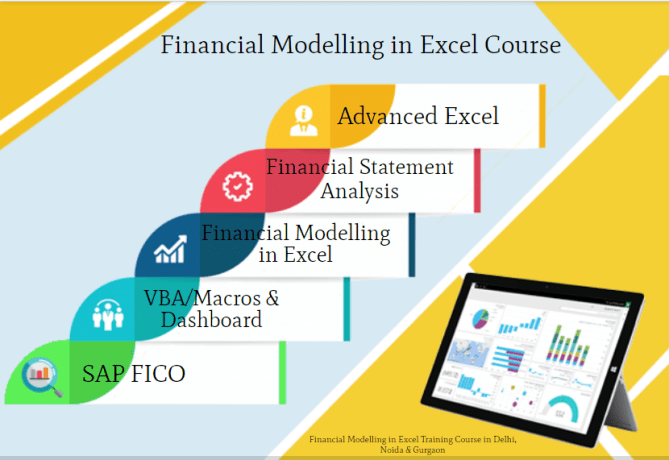

Free SAP FICO Certification: Gain expertise in SAP’s leading financial management module, highly valued by employers for automating and optimizing financial processes.

-

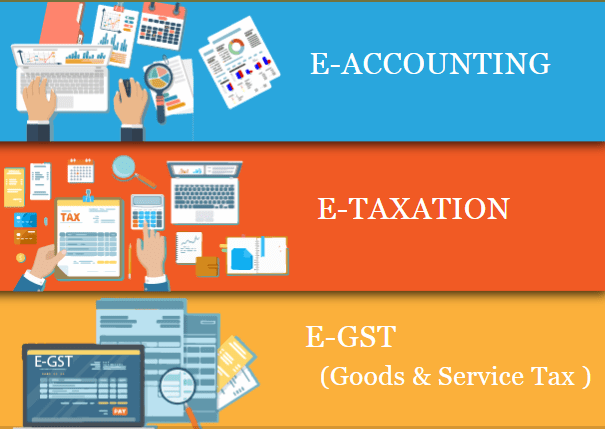

GST Certification: Stay updated with the latest Goods & Services Tax regulations and compliance practices.

-

ITR & DTC Classes (2025 Update): Learn the latest income tax return filing and direct tax code procedures, ensuring you’re compliant with current laws.

-

Tally Prime Certification: Master Tally Prime, the industry-standard accounting software for small and medium enterprises, including GST integration and advanced features

Course Modules Include:

-

Advanced GST Practitioner (by Chartered Accountant)

-

Advanced Income Tax Practitioner & TDS Practical

-

Finalization of Balance Sheet & Financial Statement Preparation

-

Banking & Finance Fundamentals

-

Customs, Import & Export Procedures

-

Advanced Excel & MIS for Finance

-

Advanced SAP FICO and Tally Prime with GST Compliance

Why Choose This Course?

-

100% job placement support upon completion

-

Hands-on, practical training with real-world scenarios

-

Certifications that are recognized and in-demand by employers

-

Updated curriculum reflecting 2025 regulatory and technological changes

Job Prospects and Industry Outlook

The demand for accounting professionals in India is strong, with a projected hiring surge in 2025. Employers are actively seeking candidates with 3–8 years of experience and those who possess up-to-date certifications in SAP FICO, GST, ITR, and Tally Prime. Completing a course with these credentials significantly increases your chances of securing a job in accounting or finance.

Conclusion

AI and automation are reshaping accounting, but they are also creating new opportunities for those with the right skills. By enrolling in an updated, certification-rich accounting course in Delhi—such as the one offered by SLA Consultants India—you ensure not just employability, but a future-proof career in the evolving world of finance.

SLA Consultants AI and Automation in Accounting: Why You Still Need an Accounting Course in 2025, 100% Job, Accounting Course in Delhi with Job, 110017 – Free SAP FICO Certification by SLA Consultants India, GST Certification, ITR & DTC Classes with 2025 Update, Tally Prime Certification Details with “New Year Offer 2025” with Free SAP FICO Certification are available at the link below:

https://slaconsultantsdelhi.in/training-institute-accounting-course/

https://www.slaconsultantsindia.com/accounts-taxation-training-course.aspx

Accounting, Finance ▷ CTAF Course

Module 1 – Advanced Goods & Services Tax Practitioner Course – By CA– (Indirect Tax)

Module 2 – Part A – Advanced Income Tax Practitioner Certification

Module 2 – Part B – Advanced TDS Practical Course

Module 3 – Part A – Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 – Part B – Banking & Finance

Module 4 – Customs / Import & Export Procedures – By Chartered Accountant

Module 5 – Part A – Advanced Tally Prime & ERP 9

Module 5 – Part B – Tally Prime & ERP 9 With GST Compliance

Module 7 – Advanced SAP FICO Certification

Contact Us:

SLA Consultants Delhi

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi – 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://slaconsultantsdelhi.in/

Report abuse

Report abuse

Featured listings

More from this user

You may also like...