Accounting Certification in Delhi NCR, Weekend GST Course in Delhi

Description

Accounting Certification in Delhi NCR

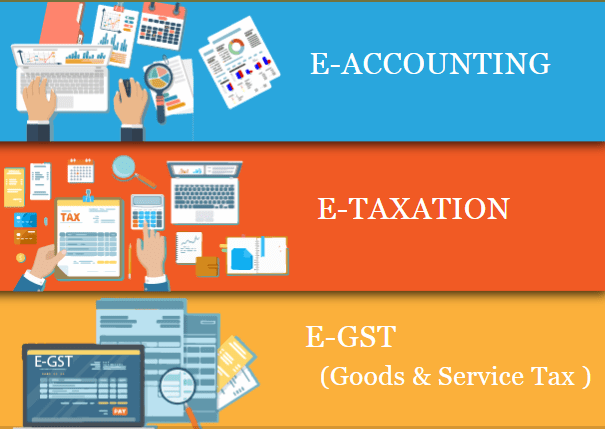

Delhi NCR is a prominent hub for accounting education, offering a wide array of certification courses tailored for fresh graduates, working professionals, and experienced accountants. These programs are designed to provide both foundational and advanced knowledge in accounting, taxation, and financial management, making candidates job-ready for roles in MNCs, banks, and corporate sectors.

Accounting Certification in Delhi NCR, Weekend GST Course in Delhi

Key Features of Accounting Certification Courses:

-

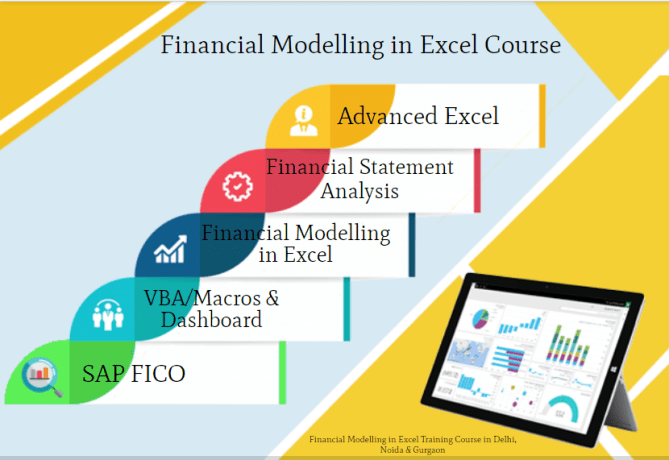

Industry-Relevant Curriculum: Courses cover core accounting concepts, GST, Income Tax, TDS, payroll, balance sheet finalization, customs, import/export procedures, and the latest software like Tally Prime, ERP 9, SAP FICO, and Advanced Excel.

-

Expert Faculty: Training is often delivered by Chartered Accountants and industry experts with extensive experience, ensuring practical and up-to-date knowledge transfer.

-

Practical Exposure: Programs emphasize hands-on learning through live projects, real-time scenarios, and case studies, enabling students to apply concepts in real business environments.

-

Flexible Learning Modes: Institutes offer both offline and online classes, including weekend and evening batches, catering to the needs of working professionals.

-

Job Assistance: Many institutes, such as SLA Consultants India, provide 100% placement support, interview preparation, and career counseling to help candidates secure relevant positions post-certification.

Popular Institutes:

-

SLA Consultants India: Offers a comprehensive “Accounting Certification Course in Delhi, including advanced modules in GST, Income Tax, TDS, SAP FICO, and Tally. The course is available in Delhi, Noida, and online, with a strong focus on practical skills and placement support.

-

NIFM: Provides Certified Accounts Professional Courses emphasizing accounting, finance, and taxation, suitable for both freshers and professionals.

-

YMCA Delhi: Features a Certificate Course in E-Accounting, GST, MS Office, and Busy Accounting Software, with a duration of three months and eligibility starting from 10+2.

Weekend GST Course in Delhi

For those seeking specialization in Goods and Services Tax (GST), several institutes in Delhi offer weekend courses designed to fit the schedules of working professionals and students.

Course Highlights:

-

Comprehensive GST Coverage: Courses include GST registration, e-filing, return filing, TDS compliances, e-invoice and e-way bill generation, and GST auditing.

-

Practical Training: Emphasis on hands-on learning using accounting software such as Tally, Busy, and SAP FICO, along with real-world assignments and live projects.

-

Flexible Scheduling: Weekend classes (typically Saturday and Sunday) allow learners to balance work or studies with skill development.

-

Certification: Upon successful completion, participants receive industry-recognized certificates, enhancing their employability in accounting and taxation roles.

Notable Weekend GST Courses:

-

SLA Consultants India: Offers a GST Practitioner Course with weekend batches, practical assignments, and 100% job guarantee. The curriculum is updated for 2025 and includes free SAP FICO training.

-

IFDA Institute: Provides an advanced GST course covering all aspects of GST compliance, including filing, auditing, and practical software training. Includes backup classes and live projects for comprehensive learning.

-

University of Delhi (School of Open Learning): Runs a two-month Certificate Course in Basics of Accounting and GST, with classes held weekly, focusing on both accounting principles and GST application. The fee is affordable, and the course is open to 12th pass candidates.

Accounting Certification in Delhi NCR, Weekend GST Course in Delhi

Conclusion

Delhi NCR offers a robust ecosystem for accounting and GST education, with flexible certification options, weekend courses, and strong placement support. Whether you are a fresher or a working professional, these programs provide the practical skills and credentials needed to advance your career in accounting and taxation.

https://slaconsultantsdelhi.in/training-institute-accounting-course/

https://slaconsultantsdelhi.in/gst-course-training-institute/

Accounting, Finance CTAF Course

Module 1 – Advanced Goods & Services Tax Practitioner Course – By CA– (Indirect Tax)

Module 2 – Part A – Advanced Income Tax Practitioner Certification

Module 2 – Part B – Advanced TDS Practical Course

Module 3 – Part A – Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 – Part B – Banking & Finance

Module 4 – Customs / Import & Export Procedures – By Chartered Accountant

Module 5 – Part A – Advanced Tally Prime & ERP 9

Contact Us:

SLA Consultants Delhi

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi – 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://slaconsultantsdelhi.in/

Report abuse

Report abuse

Featured listings

More from this user

You may also like...